Small islands join forces on debt relief ahead of climate talks

The world’s small island states plan to join forces to push for debt relief and more climate investment ahead of this year’s COP29 climate summit, part of a 10-year strategy to help save some of them from extinction, a draft document seen by Reuters showed.

The Small Island Developing States (SIDS), a grouping of 39 states and 18 associate members, are recognised by the United Nations as particularly vulnerable to rising water levels and more extreme weather as the world heats up, yet many carry a heavy debt burden that hampers their ability to respond.

Now, after years of tension with richer countries over climate finance, the islands are set to lay out joint steps to become more resilient at their fourth, once-a-decade meeting being held in Antigua and Barbuda next week.

In response to the piecemeal support offered to-date, the islands’ new plan would see the creation of a joint process to cover everything from negotiating debt relief with creditors to attracting investment and giving legal support.

Named the Global SIDS Debt Sustainability Support Service, it was co-designed by the independent, policy-focused International Institute for Environment and Development (IIED) alongside representatives from SIDS members including Samoa, Antigua & Barbuda, Trinidad & Tobago, Tonga and Tuvalu.

Others on a strategic advisory group included the World Bank, Wall Street bank JPMorgan (JPM.N), opens new tab, insurance advisor and broker Willis Towers Watson and the Commonwealth Secretariat, a voluntary association of 56 countries that evolved out of the British Empire.

While a recent report by the Grantham Institute put the annual cost of adapting all developing countries to the impacts of climate change at up to $2.4 trillion a year, a report to be released by the

United Nations Development Programme on Monday said the collective cost for SIDS was less than $10 billion a year, even though for some islands that would equal up to a fifth of their economic output.

Given the relatively small amount of money needed, the UNDP said the SIDS “pose a test case” for the world’s financial institutions to address climate vulnerability “at speed and scale”.

OVERCOMING SIZE HANDICAP

The SIDS’ new four-step plan involves a “strategic layering” of debt relief measures such as contingent debt clauses to allow governments to invest in better infrastructure and other forms of climate resilience.

To protect against future damage, countries would get help in accessing insurance and other tools as well seek more diverse forms of finance through the capital markets, such as bonds tied to protecting the environment.

With many small islands reliant on just one or two people to run the entire debt process, the Support Service would also provide legal and commercial negotiation assistance, helping overcome their limitations.

“Due to our small size, it is not easy to attract investments at the scale we really need,” Thoriq Ibrahim, the Maldivian Minister of Environment and Energy told Reuters.

More than 40% of SIDS are in or approaching debt distress, where most income goes to servicing their debt repayments, and 70% have debt that exceeds a level seen as sustainable, IIED analysis shows.

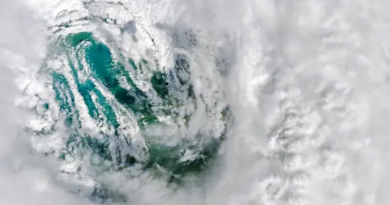

This leaves them particularly exposed if disaster strikes. For example, when Hurricane Maria hit the Caribbean island of Dominica, it caused damage equivalent to more than two years of economic output.

This can mean a country is not just unable to repay its loans but also needs to borrow more to rebuild – often at market rates or under conditions that make some of the money flow back to richer countries – trapping it in a cycle that can be hard to escape from.

“Borrowing is no longer cheap,” said Patricia Scotland, secretary general of the Commonwealth, citing global high interest rates and volatility linked to high debt burdens, “frequent climate shocks” and economic recovery from the COVID-19 pandemic.

DESPERATION

Agreeing how much richer countries will spend annually to help developing countries, including the island states, will be in focus at the November COP29 talks in Azerbaijan and comes amid an overhaul of the international financial architecture.

While various bodies are offering more help to SIDS, the Support Service marks a step-change in how the islands respond to climate risk and is set to inform their negotiating position at the summit.

“There has never been a coordinated approach to debt alleviation, debt sustainability, and it has never been put within the context of a long-term plan for financial resilience in those countries,” said IIED Executive Director Tom Mitchell.

He said it was basically asking the world to help small island states survive at a cost which was “a rounding error in terms of big international finance.”

Part of the debt relief process could include countries performing joint restructuring or swap issuance, as well as sharing legal support costs to spread the burden.

Many of the island states, such as Vanuatu or Nauru, are poorer, but even those relatively better off, such as Singapore or the U.S. Virgin Islands, show climate vulnerability similar to the world’s

Least Developed Countries, IIED analysis showed.

The issue is particularly acute for the tourism-reliant Maldives, faced with widespread coral bleaching as ocean temperatures rise and a need to adapt its l00-plus low-lying islands to climate change-driven erosion.

“Development is about climate adaptation… we are forced to make a choice between whether to construct hospitals and schools in the islands or make revetments to protect the islands,” Ali Naseer Mohamed, the Maldivian Ambassador to the United Nations said.

Source: Reuters