Sustainability is a Driver of Innovation, Not an Expense to Manage

Original heading: Guest Post: Sustainability is a Driver of Innovation, Not an Expense to Manage

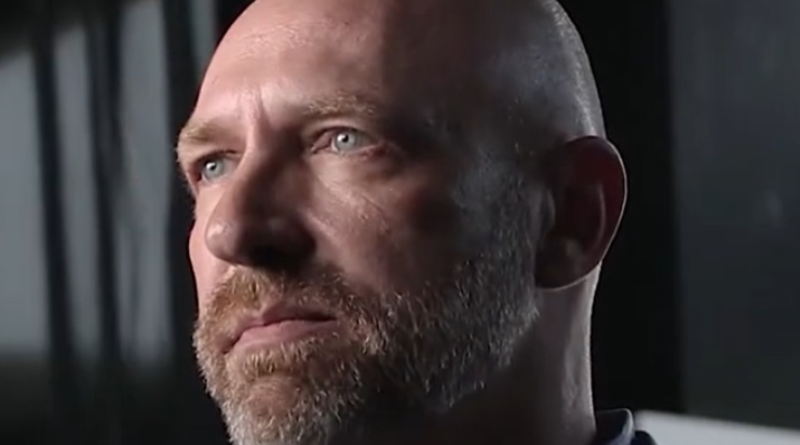

By: Chad Spitler, CEO and Founder, Third Economy

The past 12 months have seen an unprecedented number of policies and regulations related to sustainability – from the SEC’s landmark climate risk reporting rule to California’s SB-261 and SB-253, to the EU’s ESRS and CSRD.

But this ambitious agenda has been impeded, as legal challenges have tangled up regulatory proposals in the courts. The result is a stalemate of epic proportions, as corporations hit the pause button on their climate-related reporting and sustainability increasingly becomes perceived as a burdensome compliance exercise.

We need to stop thinking about sustainability as an expense for companies and start focusing on its role in innovation and revenue generation.

Sustainability, at its core, is all about innovation - helping companies achieve competitive advantages, capitalizing on macroeconomic trends and ensuring long-term viability through market disruptions both in terms of cost savings AND revenue growth.

Read on for key arguments around sustainability’s role in company innovation and how to reframe your company’s investment against an uncertain reporting backdrop.

Sustainable Businesses are Resource-Efficient vs Resource-Heavy

Today’s rhetoric paints sustainability as “impos[ing] billions of dollars of new costs and compliance burdens on businesses of all sizes”.(U.S. Chamber of Commerce in its litigation against the recent CA Climate Disclosures). But the truth is that sustainability drives resource efficiency – by shining a light on materials use and waste production, companies can create innovative solutions, optimize processes and better insulate against potential market shocks and ensure an effective supply chain. These savings and improvements ultimately free up the company to reallocate resources for even more innovation, like developing new products or services that address social and environmental needs.

Companies focused on sustainable innovation and resource efficiency are more resilient during crises, experience less share price volatility, and generate more long-term revenue.

Sustainability offers a bridge to innovation, not a burden.

Sustainability Enables Better Hiring, Better Training and More Collaboration

While the S component of “ESG” often weathers the loudest backlash from the anti-sustainability crowd, it’s focus on human capital is one of the biggest opportunities for growth and innovation for companies today.

Hiring and retaining the best talent is always a strategic investment – from building a pipeline of the best and brightest employees, to developing the policies and programs to keep people engaged, to creating a culture that encourages creative thinking around complex problems. Companies with engaged and healthy employees tend to have lower turnover rates, higher productivity, fewer accidents and better brand reputation, all key factors that directly impact financial performance. A workforce that is well-equipped to do their job through clear and consistent training is more effective, more adaptable to a changing business environment and better supported to move the company forward.

Investing in a robust human capital program is taking a loan out on the future innovation of your company. What reporting alone fails to recognize is the forward-looking opportunity that human capital presents and its opportunity to insulate against potential losses.

Sustainability is What Investors Want

In 2024, global investors continue to see sustainability as a critical driver of company innovation. But this goes beyond just dropping a report full of data into their laps – it’s about how you use and synthesize the reporting data to make better, more strategic decisions for your company.

According to a 2024 study by researchers at Stanford Graduate School of Business, the Hoover Institution Working Group on Corporate Governance, and the Rock Center for Corporate Governance in collaboration with the MSCI Sustainability Institute, “risk-minded investors are paying attention to climate-related financial risk, the opportunity that comes with the shift to a clean-energy economy, and the importance of sound governance.”

In company-speak, this equates to seeking insights on how businesses are mitigating risk, investing in strategic, market-driven opportunities, and resourcing for any and all continuity plans.

Focusing purely on reporting misses out on the information that investors actually seek – how your company is pursuing growth opportunities for long-term value creation. Investors seek reporting to see that you are using ESG to build a better company, not reporting for reporting’s sake.

Sustainability Constraints Inspire Creativity

Finally, a focused approach (like ESG reporting) can often lead to more creativity and innovation.

Instead of thinking about sustainability as a limitation (or an expense) on your business, consider the positive effects of systems parameters and regulatory standards, which can push teams to develop new solutions that may not have been developed under more open circumstances. This contrasts with business strategy that comes without constraints, which often leads to business as usual and employees taking the path of least resistance.

By leveraging new design constraints focused around ESG factors, businesses can create efficient, cost-effective, and environmentally friendly products and processes that meet today’s market, beyond reporting.

Conclusion

A focus on sustainability is a net benefit for all: enabling reduced operating costs, a more engaged workforce, new clients, happier investors, and lower environmental impacts for our planet’s health and safety. Before you write off sustainability as pure dollars and cents, consider the long-term opportunities that the practice enables and the insights that ultimately drive business growth.

You are leaving profit on the table if you consider sustainability only a reporting exercise and not a driver of innovation.

Source: esgtoday.com