Sustainability professionals turning to AI for help with materiality assessments, Reuters Events survey shows

Sustainability reporting and data collection – more specifically, the ability to report sustainability data accurately and compliantly – are amongst the most pressing challenges facing organizations today.

Driven by creeping regulatory need, and more corporate desires for transparency, sustainability practitioners are facing the unenviable task of drawing relevant data from dozens, if not hundreds, of stakeholders and interpreting it all into a single output. This, in turn, is placing additional pressures on investments and procurement, with practitioners seeking ever more comprehensive and sophisticated tools to meet their needs.

New, proprietary research from Reuters Events has revealed how sustainability practitioners are responding to this challenge. It shows emerging technology procurement trends, the first-hand experiences of using specific technologies and the remaining barriers to unlocking such investment.

As the below chart illustrates, respondents to Reuters Events’ Sustainability Reporting and Data Management 2024 survey, opens new tab indicated that internal data analysis solutions, emissions-accounting solutions, and supplier surveys and audits were the leading investments over the past 12 months.

This could be interpreted to read that sustainability practitioners have spent much of the last year putting into place the key building blocks for accurate and compliant reporting; getting the required data into the business, analyzing it internally and using it, in particular, to identify emissions. This fits the bill of organizations that are now building out their reporting function and capability, driven by implementation of new reporting requirements and regulations.

Sustainability professions are indicating a material trend towards AL, ML and Blockchain-powered reporting tools. Source: Reuters Events’ Sustainability Reporting and Data Management 2024 survey Purchase Licensing Rights, opens new tab

But there is a distinct shift when we assess the investment sentiment for technology investments that are planned over the next three years. Respondents to the survey indicated that they are more commonly planning investments in ESG data-management platforms, AI for use in materiality assessments, and sustainability risk management solutions.

This corresponds with a broader increase in sentiment around more advanced and sophisticated reporting tools, which also includes predictive analytics and blockchain for use in logistics and sourcing.

AI for use in materiality assessments witnessed particular growth in investment sentiment, rising from the 15th-most popular (or second-last) area for investment from the technologies we surveyed around, to the second-most popular for future investments. While interest in AI in general – and generative AI in particular – has soared in recent years, its application for use in materiality assessments likely coincides with a greater number of organizations subscribing to the International Financial Reporting Standards, opens new tab (IFRS) and Taskforce on Nature-related Financial Disclosure, opens new tab (TNFD) reporting standards, both of which require materiality and double materiality assessments.

More broadly, the findings point to an appreciation that today’s suite of sustainability reporting tools and capabilities are insufficient for the future reporting landscape. More sophisticated data collection and analysis will be required, while certain tasks will need to be automated as much as possible.

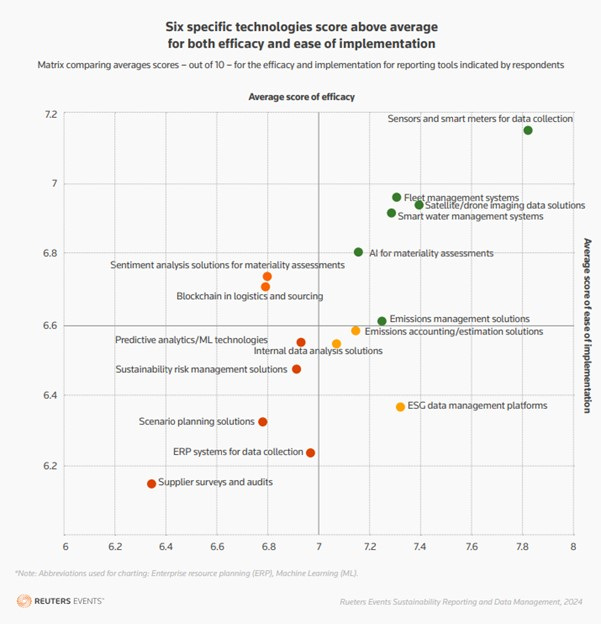

Critically, however, some of the technologies most pivotal to enabling accurate and compliant sustainability reporting fare the poorest for ease of implementation and effectiveness, according to our survey respondents.

The below chart shows the average scores (out of 10) respondents provided for our suite of sustainability tools, charting for both effectiveness and ease of implementation. The chart also shows our median score lines for both, allowing us to see technologies that score above and below average in both metrics.

Six specific technologies score above average for both efficacy and ease of implementation. Source: Reuters Events’ Sustainability Reporting and Data Management 2024 survey Purchase Licensing Rights, opens new tab

The bottom-left hand quadrant – technologies that score below average for both – includes predictive analytics and sustainability risk-management solutions, two of the top-five technologies for future planned investments. Additionally, supplier surveys and audits, critical to obtaining relevant supply chain data for Scope 3 emissions reporting, scored the poorest of all technologies in our survey.

Verbatim responses to our survey further endorsed this finding. Practitioners bemoaned them as costly and difficult to audit, with organizations lacking control over the data – including its accuracy and format – returned from them. One respondent described the use of supplier surveys as a work in progress but commented: “[It’s] hard to verify data suppliers. [They] need more capacity building and knowledge training to be able to provide the correct data accurately.”

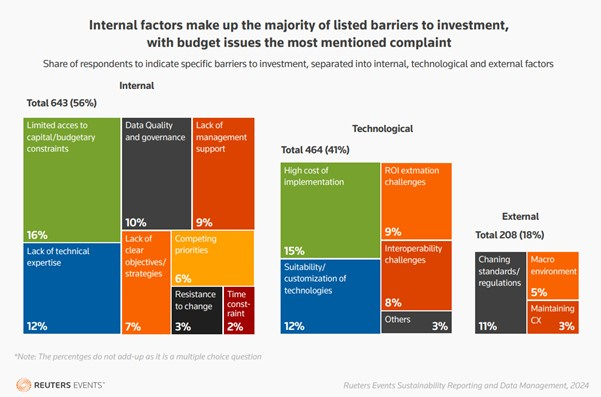

Our research has also indicated that cost is a prevalent concern for sustainability practitioners when it comes to procurement, both in terms of the cost of solutions versus their own budgets and demonstrating the return on investment to their organization’s board or senior leadership. The below chart highlights the barriers to investment mentioned by survey respondents, showing the prevalence of internal factors over others.

Internal factors make up the majority of listed barriers to investment, with budget issues the most mentioned complaint. Source: Reuters Events’ Sustainability Reporting and Data Management 2024 survey Purchase Licensing Rights, opens new tab

While technological and external factors persist, a majority (56%) of survey respondents listed internal factors as being barriers to investment, with 16% in particular mentioning budgetary constraints and a further 9% highlighting a lack of support from senior leadership.

Qualitative feedback was also sought, with difficulty in obtaining or explaining precise ROI for investments in sustainability reporting tools a common complaint. “Demonstrating a clear ROI on sustainability investments can be challenging, especially in the short term,” one respondent said, while others paid specific mention of the need to get buy-in from the organization’s chief financial officer or other person with control of budgets, especially if such investments are sizeable and/or must be justified to shareholders.

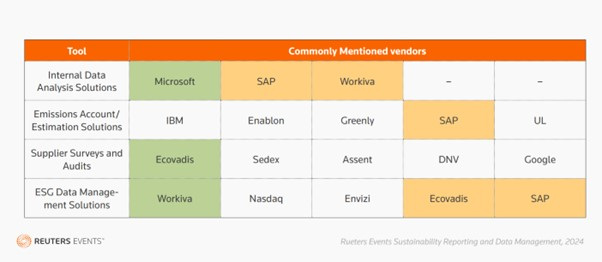

Nevertheless, investments are being made – 37% of respondents said their organization is spending at least $100,000 per year on its sustainability reporting function – with an array of vendors mentioned by our survey respondents. When asked to state which companies they are currently working with or looking to work with in the future, survey respondents identified more than 300 different companies – an indication of the scale and fragmented nature of the sustainability reporting ecosystem today.

We assessed the most commonly mentioned vendors and identified a number of suppliers, with the below table indicating those for a specific set of technologies. Those highlighted in green indicate vendors mentioned by a large number of respondents, while those highlighted in yellow indicate vendors commonly mentioned for multiple technologies. While verbatim data collected from our survey suggests that sustainability practitioners do not believe there is a single, silver bullet solution for sustainability reporting on the market today, the presence of vendors offering multiple, often related functions – data collection, management and analysis, for instance – is a trend that looks set to continue.

Commonly mentioned vendors. Source: Reuters Events’ Sustainability Reporting and Data Management 2024 survey Purchase Licensing Rights, opens new tab

The findings above are discussed in more detail within the Reuters Events Sustainability Reporting and Data Management Report 2024, which can be accessed here, opens new tab.

Source: Reuters